AI Investing isn’t fading any time soon, but investor expectations are evolving. Based on insights that we collected from 57 VC investors, this report outlines what founders need to know when raising in today’s market. The good news: most investors believe we’re still early in the AI cycle. But the bar has risen. Concerns around defensibility are high, and execution, not just vision, is the deciding factor. The data here highlights where capital is flowing, what risks are top of mind, and which signals actually build conviction.

Key Insights

We're still early in AI investing - The majority of investors believe we're in the 1st-3rd inning.

Defensibility is the top concern - Investors rate their concern about lack of moats in AI startups at 3.7/5, making defensibility strategies critical for fundraising success.

Vertical focus beats horizontal solutions - Investors strongly prefer vertical-specific AI applications over general-purpose tools, suggesting founders should target industry-specific problems.

Multiple layers of defensibility are essential - Top strategies investors look for: vertical specialization, strong GTM, workflow integrations, and proprietary data.

Feature commoditization is the biggest threat - A majority of the investors surveyed cited this as the primary challenge to long-term success, followed by customer retention and competition with incumbents.

Beware the "retention mirage" - Dedicated AI budgets are creating artificial demand and false positives for enterprise tools, making it critical for founders to distinguish between experimental usage and genuine product-market fit.

Valuation expectations remain disciplined - Most investors are comfortable in the $10M-$20M range at the early stage, with fewer accepting valuations above $30M despite the AI hype.

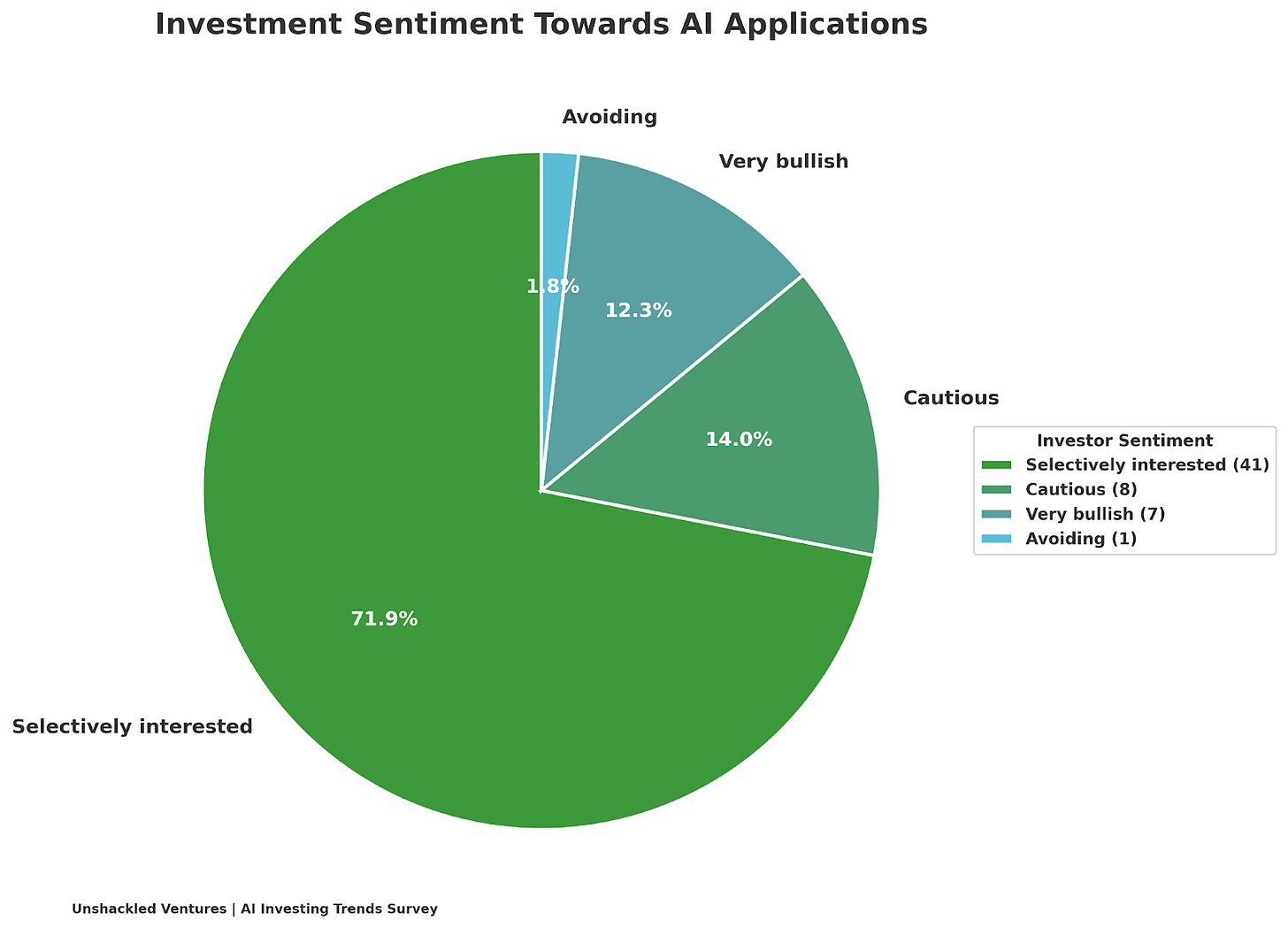

Execution and GTM matter more than technology - 72% of investors are "selectively interested" in AI applications, with decisions contingent on execution quality and go-to-market strategy.

Investor Landscape Overview

The survey captured perspectives from 57 investors, predominantly Partners (49) and Principals (8) across various fund types. The majority represent Emerging (30) and Established (21) funds, with a smaller portion from Legacy funds (6). In terms of gender distribution, the respondents included 36 male and 21 female investors, providing perspectives from a relatively diverse group of investment decision-makers.

The survey primarily captured early-stage investors, with the majority focused on Seed and Pre-seed investments. While some investors operate across multiple stages, the strong representation of Seed and Pre-seed investors provides particularly valuable insights for founders at the earliest phases of company building.

Investment Stage Breakdown:

Seed: 55 investors

Pre-seed: 38 investors

Series A: 26 investors

Series B: 9 investors

Series C: 4 investors

Geographically, the investor base spans multiple regions across North America:

San Francisco/Bay Area: 33 investors

New York City: 6 investors

Los Angeles: 6 investors

Boston: 4 investors

Chicago: 2 investors

Washington DC: 2 investors

Vancouver, BC: 1 investor

Dallas: 1 investor

St. Louis: 1 investor

Detroit: 1 investor

Market Timing: Are We Too Late?

The data is clear: The majority of investors believe we are still in the early stages (1st-3rd inning) of AI investing. Another segment sees the market as maturing but with plenty of room for winners (4th-6th inning). Only a small minority consider the market approaching saturation or overhyped.

Notably, early-stage investors are particularly optimistic about the AI opportunity. 64.5% of investors who focus exclusively on Pre-seed and Seed rounds believe we're still in the 1st-3rd inning, compared to 50% of later-stage investors.

Multi-stage investors (those who invest across both early and later stages) show similar optimism, with 66.7% believing we're in the early innings. This optimistic outlook suggests continued strong investment appetite for AI startups with the right attributes. However, the days of raising on a deck alone are largely behind us.

Where VCs Are Placing Their Bets

The survey reveals strong investor interest in vertical-specific AI applications across healthcare, legal, fintech, and other sectors (53 mentions). AI agents and copilots also attract significant attention (39 mentions).

Our stage-based analysis shows important distinctions in investment focus:

Early-stage investors (Pre-seed/Seed only) show strong preference for AI agents & copilots (67.7%) and AI-powered robotics & automation (54.8%)

Later-stage investors (Series A+ only) demonstrate more diverse interests, with equal attention (50%) to foundational models and AI agents

Multi-stage investors follow similar patterns to early-stage investors, with 70.8% interested in AI agents & copilots

The overall focus on specialized applications rather than general-purpose solutions is telling. Investors are gravitating towards founders who are considering industry-specific use cases that solve concrete problems within established verticals rather than building yet another horizontal AI tool.

The Defensibility Challenge

Let's address the elephant in the room: defensibility.

Investors express significant concerns about the lack of defensibility in early-stage AI startups, with an average concern level of 3.7 out of 5 and a median of 4.0 (based on all 57 respondents). This high level of concern underscores the importance for founders to articulate clear moat-building strategies from day one.

Our stage-based analysis highlights that defensibility concerns intensify as companies progress to later stages:

Later-stage investors show the highest concern about lack of moat (average 4.00/5)

Early-stage investors show moderate-high concern (average 3.71/5)

Multi-stage investors show slightly lower concern (average 3.67/5)

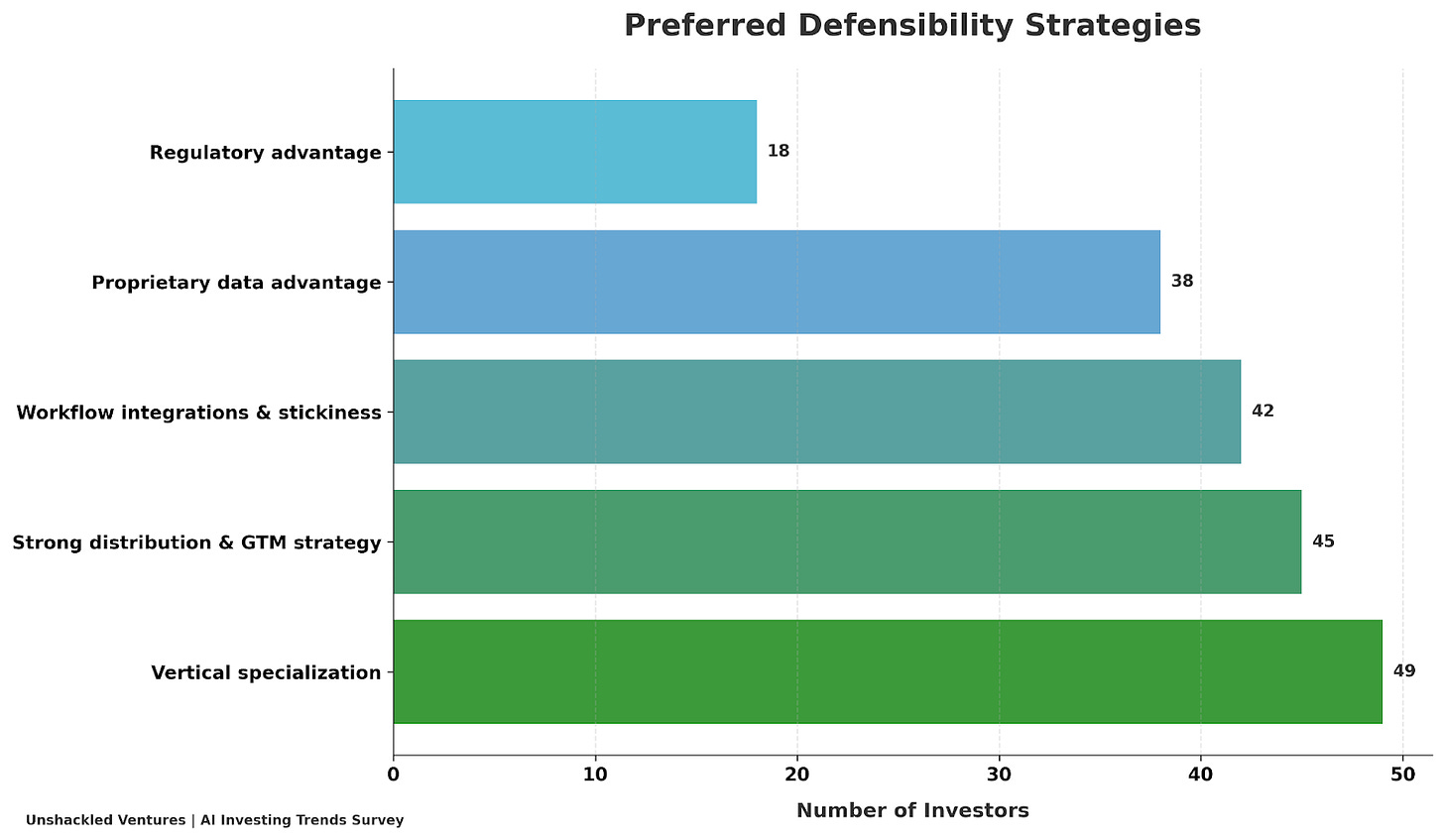

When evaluating defensibility strategies, investors prioritize:

Vertical specialization (49 mentions)

Strong distribution and go-to-market strategy (45 mentions)

Workflow integrations and stickiness (42 mentions)

Proprietary data advantage (38 mentions)

Regulatory advantage (18 mentions)

Vertical specialization emerges as the most universally valued defensibility strategy across all investor stages:

90.3% of early-stage-only investors value vertical specialization

100% of later-stage-only investors value vertical specialization

79.2% of multi-stage investors value vertical specialization

Interestingly, regulatory advantage gains importance at later stages, valued by 50% of later-stage-only investors compared to 32.3% of early-stage-only investors.

The message is clear: focus on building domain expertise in specific verticals and developing robust distribution channels rather than relying solely on technological innovation. The emphasis on workflow integration indicates that embedding AI solutions deeply into user workflows creates stickiness that investors value.

Investment Sentiment: What VCs Really Think About AI Applications

Among all 57 respondents, the majority (41 investors or 72%) are "selectively interested" in AI applications, with investment decisions contingent on execution quality and go-to-market strategy. Only 8 investors (14%) express caution due to competition and defensibility concerns, while 7 investors (12%) remain very bullish about differentiation opportunities.

This measured optimism suggests that while the door remains open for AI startups, the bar for investment has risen. Investors are becoming more discerning about which companies receive funding, focusing on those with clear differentiation and execution plans.

The Biggest Challenges to Long-Term Success

Investors identify several critical challenges that AI startups must overcome:

Feature commoditization (47 mentions)

Customer retention and churn (37 mentions)

Competition with large incumbents (32 mentions)

Margins and unit economics (12 mentions)

Model performance and accuracy (7 mentions)

Feature commoditization emerges as a universal concern across all investor stages:

93.5% of early-stage-only investors cite feature commoditization

100% of later-stage-only investors cite feature commoditization

66.7% of multi-stage investors cite feature commoditization

"I'd love to hear some independent insights and tailwinds around the market or opportunity. I worry there are too many teams who have a tool and are just trying to find problems to solve with it."

- Pre-Seed, Seed, & Series A Investor

The prominence of feature commoditization as a concern highlights the risk that AI capabilities may quickly become table stakes rather than differentiators. Founders should develop strategies to continuously innovate beyond easily replicable features and focus on building sustainable competitive advantages.

The Retention Mirage: Watch Out For AI Budget-Driven False Positives

Customer retention and churn emerged as the second most significant challenge (37 mentions), highlighting a critical but often overlooked risk in the current AI landscape: the "retention mirage" created by temporary AI budgets.

"I wish I knew about retention - hard to evaluate revenue ramps without knowing what sticks. Every company has basically unlimited budget for AI spend right now."

- Pre-Seed, Seed Investor

This observation points to a significant challenge for founders, particularly those building enterprise or B2B AI solutions. Many large companies have established dedicated "AI budgets" specifically earmarked for experimenting with new AI tools and technologies. These budgets create an artificial environment where:

Initial adoption is artificially high - Companies are incentivized to try new AI tools using these dedicated budgets.

Purchase decisions are less rigorous - The threshold for purchasing is lower when using experimental budgets versus core operational budgets.

Renewal decisions will face different scrutiny - When renewal time comes, these tools will need to justify their value against core budgets and ROI expectations.

For founders, this creates a dangerous scenario where early traction metrics may represent false positives rather than genuine product-market fit. What appears to be strong initial adoption could mask fundamental issues with long-term value delivery and retention.

The stage-based analysis shows that this concern is particularly acute among later-stage investors, who have seen similar technology hype cycles play out before. They recognize that many enterprise AI tools currently benefiting from experimental budgets will face a "moment of truth" when those budgets normalize and tools must compete for core operational spending.

Founders should consider several strategies to address this challenge:

Track retention cohorts meticulously - Distinguish between experimental users and those who have integrated the tool into core workflows

Measure depth of usage, not just licenses - Are customers using the product in ways that indicate true integration into workflows?

Focus on ROI measurement - Help customers quantify the value your tool delivers to strengthen renewal cases

Target budget-holders beyond innovation teams - Ensure your product appeals to the departments that control core operational budgets

Build multiple layers of stickiness - Workflow integration, data accumulation, and network effects can help ensure retention when experimental budgets dry up.

A Pre-Seed/Seed investor commented, "For consumer AI seed - want to see early indications of retention or engagement and/or word of mouth growth". Another Seed/Series A investor emphasized the importance of "rabid signs of customer love". Indicators that go beyond simple usage metrics to demonstrate genuine dependency on the product.

In an environment where AI budgets may be creating artificial demand, founders must look beyond initial traction metrics and focus on building products that deliver value so compelling that they'll survive the inevitable budget normalization.

Valuation Reality Check

Regarding valuation, results in through the survey suggests that despite enthusiasm for AI, investors maintain disciplined approaches to valuation. Founders should calibrate their expectations accordingly, particularly at early stages.

“[I need to see a] reasonable price. Too many are interesting companies but at a 40x multiple, the risk is too fully baked in.”

- Seed & Series A Investor

Early-stage investors have more conservative valuation expectations:

93.5% are comfortable with $10M-$20M valuations

Only 6.5% accept $30M-$50M valuations

Later-stage investors expect higher valuations:

100% are comfortable with $30M-$50M valuations

50% accept $10M-$20M, $20M-$30M, and $50M+ valuations

Multi-stage investors show greater flexibility across valuation ranges:

87.5% accept $10M-$20M

79.2% accept $20M-$30M

54.2% accept $30M-$50M

29.2% accept $50M+

Metrics That Matter to Investors

When evaluating AI startups, investors look for various signals depending on the stage:

Pre-seed:

Team expertise (both vertical domain knowledge and AI technical capabilities).

“Definitely looking for team expertise at the earliest stages, with a mix of vertical expertise and AI chops.”

- Pre-Seed Investor

“IT’S ALL ABOUT THE FOUNDERS!! We look for repeat founders who have built $B+ biz before ("human unicorns").”- Pre-Seed Investor

“Team's knowledge and experience in the vertical they are targeting, early customer traction, experienced enterprise BD/Sales team.”

- Pre-Seed/Seed Investor

Seed:

Early signs of product-market fit, typically 2-3 pilots with potential customers.

An investor who invests across Pre–Seed, Seed, Series A, & Series B noted, “We're finding that best-in-class AI startups can go from $0 to $4-5M+ in revenue in a single year with a lean team. All about velocity/execution and earned secrets.”

Post-seed:

Paying customers, revenue quality (not just growth but retention metrics), and engagement quality.

“Customers, use, and reuse. Economic impact has to be obvious. Some virality.”

- Series A/Series B Investor

All stages:

Differentiation in data strategy, clear go-to-market motion, and evidence of customer stickiness.

One Seed/Series A investor noted they specifically look for, "differentiation on the data front, and revenue and engagement quality," highlighting that growth metrics alone are insufficient if accompanied by high churn or predominantly pilot revenue.

Conclusion

The AI investment landscape remains exciting, with significant opportunities for founders despite growing concerns about defensibility and commoditization.

The data suggests that while enthusiasm for AI continues, investment decisions are increasingly driven by fundamentals rather than hype, with particular emphasis on vertical specialization, distribution advantages, and sustainable unit economics.

Our stage-based analysis shows significant differences in how early-stage, later-stage, and multi-stage investors approach AI investments. Founders should tailor their pitches accordingly, emphasizing opportunity and differentiation with early-stage investors while focusing more on defensibility, execution, and sustainable growth with later-stage investors. Multi-stage investors often represent a middle ground, combining early-stage optimism with later-stage discipline.

For founders, the path to funding requires demonstrating not just innovative AI technology but also clear strategies for building defensible businesses with strong customer retention. As the AI sector continues to evolve rapidly, we hope that these insights provide a valuable compass for navigating the complex intersection of technology, market opportunity, and investment potential.

About Unshackled Ventures: Unshackled Ventures is the only early-stage venture capital fund that enables unrecognized and excluded immigrant founders to start companies in the U.S. Since its founding in 2014, Unshackled has proven its thesis that investing and supporting this population drives strong investment returns across key industries, including American infrastructure, generative AI, healthcare, space, and enterprise SaaS. To date, the firm has invested in over 90 companies and over 250 entrepreneurs.