Executive Summary

In April 2025, Unshackled Ventures anonymously surveyed 32 immigrant startup founders across its portfolio to gauge their sentiments amidst evolving economic, immigration and trade conditions. The findings highlight a community exhibiting strong short-term confidence in their ability to operate within the U.S., yet facing significant challenges in fundraising due to macroeconomic headwinds.

“We have a positive outlook and are leveraging all change to our advantage.” — Unshackled founder

Key Insights

Short-Term Confidence Remains High:

A majority of founders express strong confidence in their immediate ability to stay and build in the U.S., with 84% rating their short-term confidence as high (scores 4 or 5).

Long-Term Outlook Holds, with Cautious Undercurrents:

Confidence remains generally positive over the long term—65% rate themselves as confident or very confident. However, 25% report neutral sentiment, and 9% express concern, pointing to growing uncertainty about what lies ahead, particularly for those navigating early-stage growth and temporary visa categories.

Fundraising Emerges as Primary Concern:

The predominant challenge identified is the difficulty in securing funding, surpassing concerns over immigration policies. Founders cite a tightened investment landscape and prolonged fundraising cycles as significant hurdles.

Immigration Concerns Less Pronounced:

Compared to previous periods, immigration-related anxieties have diminished, with many founders adapting to existing policies and focusing more on immediate business challenges.

Resilience and Adaptability:

Despite obstacles, founders demonstrate a pragmatic approach, adjusting strategies to navigate the current economic climate and maintain business momentum.

Introduction: A Detailed Examination

This report presents a detailed analysis of sentiment among immigrant founders in the United States, based on the Unshackled Founder Sentiment Survey conducted in April 2025. The survey engaged Unshackled 32 founders across diverse sectors (Deeptech, Robotics, AI, AR/VR, Health and Digital Health, CPG, Agtech, Fintech, Cleantech, Hardware, Software/SAAS, Consumer, Enterprise, Ecommerce), company stages (from pre-seed to Series B+), and immigration pathways.

At Unshackled, understanding the lived experience of these entrepreneurs—in all its complexity—is paramount. This analysis delves into their confidence levels, economic outlook, experiences with immigration policy, and overall mindset, aiming to provide unfiltered insights into how founders are navigating today’s climate of uncertainty, innovation, and transformation. By examining aggregate trends, nuanced differences across key segments—company stage, industry group, and immigration status—and presenting the full sentiment distribution, this report offers a comprehensive perspective for stakeholders supporting this vital part of the innovation ecosystem.

Founder Confidence: Examining Short-Term Stability and Long-Term Uncertainty

Founders express notable confidence in their immediate ability to operate in the U.S., contrasting with greater uncertainty regarding their long-term prospects. The full 1-to-5 confidence scale reveals essential details beyond the overall averages (Short-Term Mean: 4.41, Long-Term Mean: 4.09).

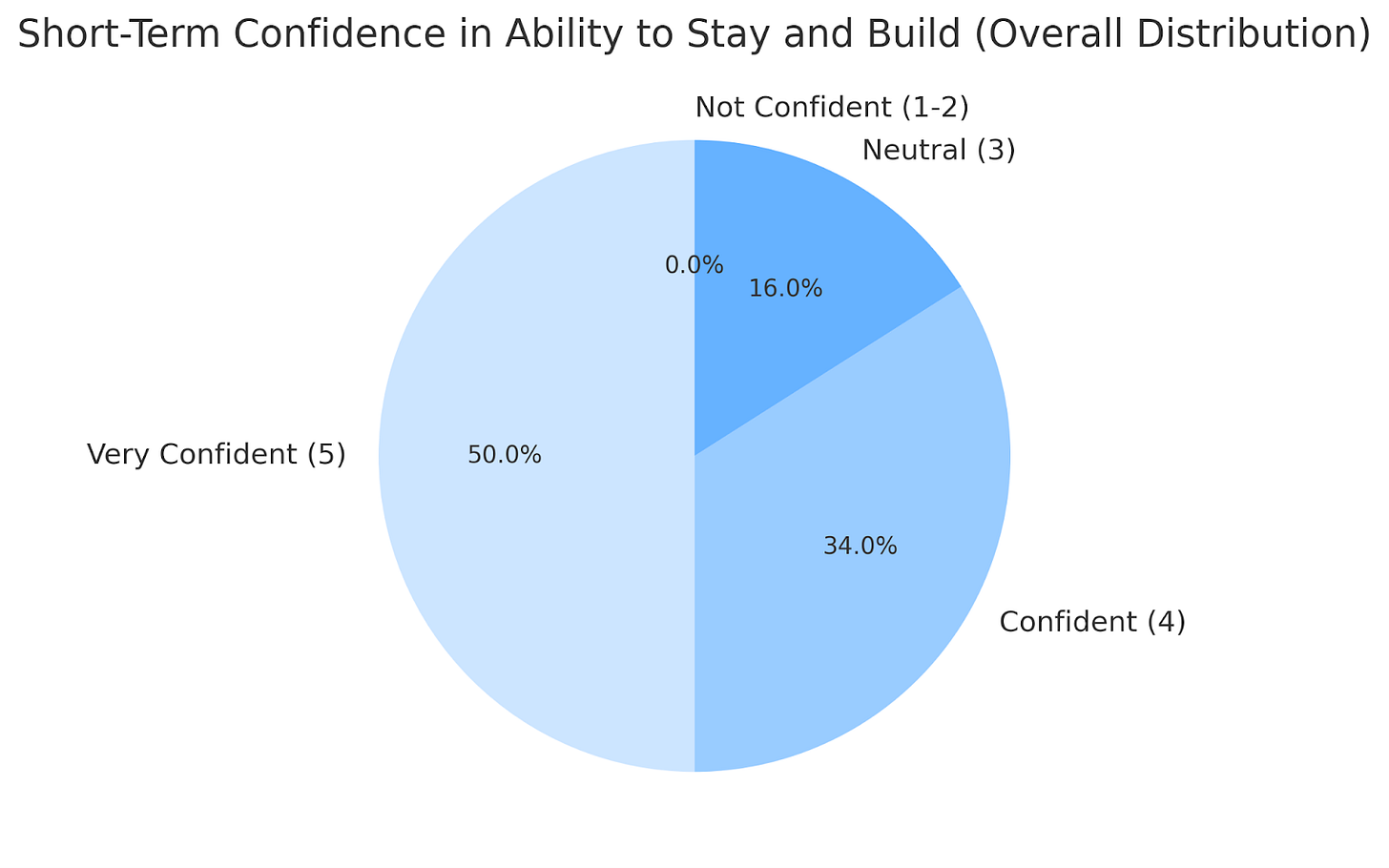

Short-Term Confidence (Ability to Stay and Build)

Overall Distribution: Confidence is strongly skewed towards the positive end. A significant 50% of founders report being very confident (score 5), and another 34% report being confident (score 4)—only 16% express neutral confidence (score 3). Critically, no founders reported negative confidence (scores 1 or 2) regarding their short-term prospects, indicating widespread immediate operational stability.

By Company Stage: High confidence (score 4 or 5) is prevalent across stages: Series A (100%), Pre-Seed/Ideation (86%), Seed (86%), and Series B+ (80%). Neutral responses (score 3) appear slightly more among Pre-Seed/Ideation (14%), Seed (14%), and Series B+ (20%) founders. The single Growth stage founder reported neutral confidence (score 3).

By Industry Group: High confidence (score 4 or 5) is strong across industries, notably FinTech (100%), Other/Healthcare (100%), Hardware/Deep Tech (86%), Consumer Goods/Services (83%), and Software/Platform (83%). AI founders show 75% high confidence, with 25% reporting neutral confidence (score 3).

By Immigration Status: 83% of Green Card holders, 82% of Work Visa holders, and 87.5% of U.S. Citizens report high confidence (score 4 or 5). Student Visa holders are split between very confident (50% score 5) and neutral (50% score 3).

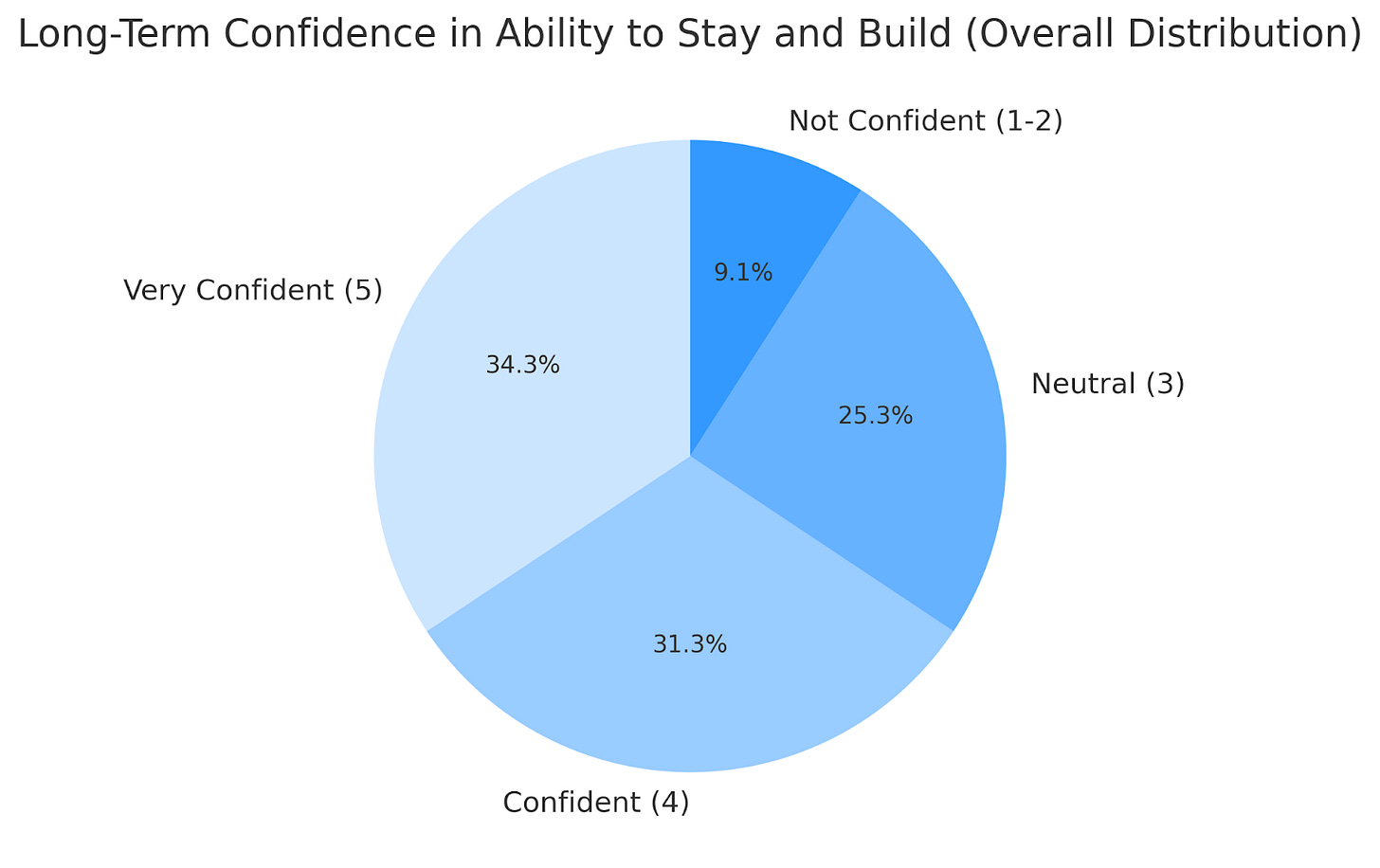

Long-Term Confidence (Ability to Stay and Build)

Overall Distribution: The lower mean score reflects a broader spread. While a majority still express high confidence (34% score 5, 31% score 4), the proportion reporting neutral confidence (score 3) increases significantly to 25%. A slight but notable 9% report negative confidence (scores 1 or 2), highlighting underlying anxiety about the future.

By Company Stage: Series A founders remain highly confident (100% score 4 or 5). Seed stage founders are most cautious: only 57% report high confidence (score 4 or 5), 29% are neutral (score 3), and 14% express negative confidence. Pre-Seed/Ideation (64% score 4/5, 36% score 3) and Series B+ (60% score 4/5, 40% score 3) also show more tempered long-term confidence.

By Industry Group: Consumer Goods/Services founders maintain high long-term confidence (83% score 4/5). AI founders also remain relatively positive (75% score 4/5). However, neutral sentiment (score 3) becomes prominent among FinTech (50%), Software/Platform (50%), and Hardware/Deep Tech (43%) founders. Hardware/Deep Tech sees only 57% reporting high confidence (score 4/5).

By Immigration Status: Long-term confidence varies distinctly by status. High confidence (score 4 or 5) remains strong among Green Card holders (83%) and Work Visa holders (73%). However, Student Visa holders show a significant presence of neutral sentiment (50% score 3), alongside high confidence (50% score 4/5). U.S. citizens also show a wider distribution in the long term (62.5% score 4/5, 25% score 3).

This detailed examination underscores that while short-term confidence is robust, long-term confidence is more varied and influenced by factors like company stage and immigration status. The neutral score (3) represents a significant stance for many founders, particularly concerning the long term, indicating watchful uncertainty rather than outright negativity.

Economic Headwinds and Macroeconomic Concerns: A Spectrum of Views

The survey reflects founders’ awareness of economic challenges, but their outlook presents a spectrum of views rather than uniform pessimism. While “somewhat pessimistic” (38%) is the most frequent single response regarding the U.S. economy, a combined total of 53% of founders expressed Neutral (25%), somewhat optimistic (16%), or very optimistic (12%) views.

Key Concerns: The fundraising climate remains the dominant macroeconomic worry across segments, followed by inflation, global instability, and consumer demand.

Segment Variations: Pessimism is more concentrated among pre-Seed/Ideation founders and those in the AI industry. Optimism or neutrality is more apparent among FinTech founders and those ‘In transition’. Green Card holders also expressed more pessimism than other immigration statuses.

This data indicates a realistic assessment of the economic climate, where challenges are acknowledged alongside neutral or optimistic perspectives.

Navigating the U.S. Environment: Support, Policy, and Perception

The founders offer mixed perspectives on the supportiveness of the U.S. environment and the impact of recent changes, highlighting the diversity of their experiences.

Environment Supportiveness: Overall sentiment is divided: 38% Agree/Strongly Agree that the environment is supportive, 31% Disagree/Strongly Disagree, and 31% are Neutral. This distribution underscores the varied lived experiences. Segments reporting more positive perceptions include Series A founders, FinTech and Consumer Goods/Services industries, and U.S. Citizens/those ‘In transition’. Seed stage founders and AI/Software Platform founders report more neutral or negative perceptions.

Confidence Change: The most significant single response regarding confidence changes due to recent events was “No change” (50%), suggesting adaptation or stability for many. More founders reported decreased confidence (28%) than increased confidence (22%). Series A founders and those ‘In transition’ reported more positive shifts, while Work Visa holders leaned towards negative shifts or no change.

Qualitative insights consistently point to immigration policy complexity, delays, and uncertainty as major stressors, particularly for those on temporary visas. The quantitative data reflects this complexity, showing a wide range of perceptions about support and confidence shifts.

Founder Perspectives on Tariffs and Trade

Most immigrant founders reported that tariffs and international trade policies have had no meaningful impact on their business. 59% indicated they are not experiencing any disruption, reflecting the nature of the technologies they’re building—largely software-based or domestically operable. Meanwhile, 28% reported either some impact or said they are closely monitoring the situation, and 9% noted a significant impact, typically tied to hardware, deep tech, cleantech or manufacturing sectors with international exposure.

For the majority, global trade tensions and tariff shifts remain peripheral to daily operations, underscoring that many immigrant-led startups in this cohort are building tools, platforms, and services that do not depend heavily on international imports or cross-border supply chains. These companies are more shielded from trade-related volatility and instead focus their attention on challenges like fundraising, hiring, and navigating immigration systems.

However, for the smaller subset working in globally integrated industries, trade policy remains a meaningful variable. These founders actively monitor geopolitical trends and adapt operations accordingly—demonstrating a pragmatic, forward-looking approach to managing external risk.

“Tariffs didn’t break us. They made us more disciplined.” - Unshackled Founder

The Immigrant Founder Mindset: Pragmatism and Determination

The immigrant founder mindset revealed in the survey by examining qualitative comments is characterized by pragmatism, determination, and resilience. While acknowledging significant challenges—reflected in words like “Uncertain,” “Challenging,” and “Risky”—their focus remains on building and executing.

Founders across segments demonstrate adaptability, adjusting strategies to manage cash flow, navigate funding cycles, and overcome administrative hurdles. They consistently articulate their value proposition as job creators and innovators, pushing back against misconceptions. The desire for clearer immigration pathways and a more stable operating environment is strong, but it coexists with a determination to succeed within the current system.

The lived experience involves managing the unique pressures of immigration status alongside universal startup challenges. This requires a high degree of rigor and adaptability, qualities evident in the survey responses.

Quotes From the Field

“I am confident I will find my way with the amount of resources available to me and Unshackled behind me.” — Unshackled founder

“We have a positive outlook and are leveraging all change to our advantage.” — Unshackled founder

“The US has the best start-up climate in the world; immigrants build the whole country.” — Unshackled founder

Conclusion

The April 2025 Unshackled Founder Sentiment Survey reveals a community of immigrant entrepreneurs that is both resilient and acutely attuned to the realities of today’s startup environment. While short-term confidence remains high—bolstered by a sense of belonging, operational readiness, and support networks—the long-term outlook reflects watchful pragmatism rather than overt pessimism. Founders are keeping one foot firmly in the present, building actively and with conviction, while keeping the other in a future that feels less certain—not because of personal limitations, but due to external constraints that may shift without warning.

What stands out most is that immigration, though still complex and emotionally taxing for many, is no longer the loudest source of anxiety. Fundraising has taken its place. Across industries and stages, founders consistently point to a capital environment that has grown colder and more cautious. Extended timelines, investor hesitancy, and reduced check sizes are not just abstract market dynamics—they are daily roadblocks to momentum. This makes the resilience on display all the more striking: founders are adapting to leaner operations, reprioritizing growth strategies, and staying focused on execution despite a more difficult fundraising terrain.

The takeaway for investors, policymakers, and ecosystem builders is clear: support must evolve in step with founders’ reality. The opportunity isn’t just to remove friction—it’s to unlock potential. Founders are not asking for guarantees; they are asking for clarity, access, and the chance to compete on even ground. By addressing gaps in early-stage capital, simplifying immigration pathways, and recognizing the unique dual burdens immigrant founders carry, we not only support individuals—we reinforce the foundation of American innovation.